A Securities and Exchange Commission investigation into missing text messages from former chair Gary Gensler’s phone between October 2022 and September 2023 has concluded that “avoidable errors” led to their loss.

The SEC Office of Inspector General (OIG) investigated how nearly a year’s worth of text messages from Gary Gensler were permanently lost between October 2022 and September 2023, during the height of the agency’s crypto enforcement action campaign.

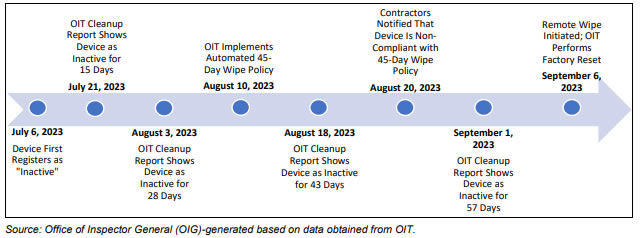

In a report released on Wednesday, the OIG revealed that the SEC’s IT department “implemented a poorly understood and automated policy that caused an enterprise wipe of Gensler’s government-issued mobile device,” which deleted stored text messages and operating system logs.

The loss was worsened by poor change management, lack of proper backups, ignored system alerts and unaddressed vendor software flaws.

The IT department failed to collect or maintain necessary log data, which is why the commission could not determine why Gensler’s smartphone stopped communicating with the SEC’s mobile device management system.

Key communications about crypto enforcement actions were lost

The OIG found that some of Gensler’s deleted texts involved SEC enforcement actions against crypto companies and their founders, meaning that key communications about how and when the SEC pursued cases may never be fully known, even to courts, Congress or the public.

Investigators reviewed about 1,500 messages recovered from colleagues and other records. They determined that the majority were federal records, with around 38% of the recovered text conversations “mission related” concerning matters directly involving SEC senior staff at the time, such as:

“A May 2023 conversation involving Gensler, his staff, and the Director of the Division of Enforcement about when the SEC would be filing an action against certain crypto asset trading platforms and their founder.”

SEC crackdown on recordkeeping

Around the same time that Gensler’s messages were disappearing into a black hole, the SEC cracked down on the use of messaging apps. Several global investment banking and financial institutions were charged with violating record-keeping and books-and-records laws under the 1934 Securities and Exchange Act.