Lawmakers in Washington are gearing up to pass three bills for the blockchain industry in an event they have dubbed “crypto week.”

The US Congress has been working on legislation that the crypto industry lobby says will help bring clarity to the industry and help it grow, primarily through two laws governing stablecoins and creating a crypto market structure. Congress is also considering a law preventing the creation of a central bank digital currency (CBDC).

Crypto has found support on both sides of the aisle, with Democratic and Republican lawmakers each making a number of amendments to the bills under consideration. Major crypto exchanges operating in the United States, like Coinbase, have stepped up their campaigning for the legislation as well.

With Congress set to take action on three critical bills during Crypto Week, here’s a look at what they’re considering and what it means for the crypto industry.

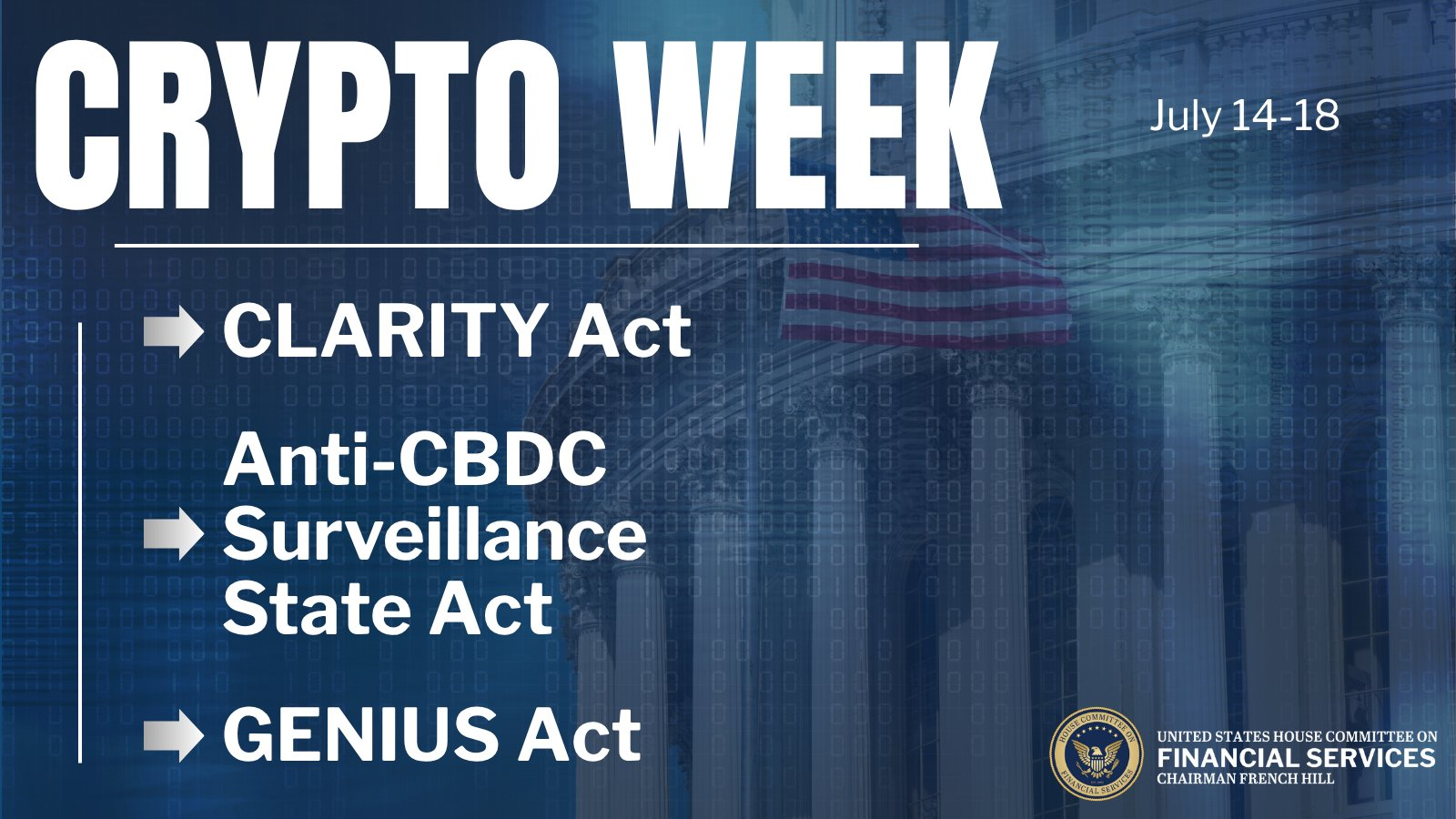

Crypto week aims to pass three bills into law

The US House Financial Services Committee announced Crypto Week would start on July 14. It will consider three bills, namely:

The Digital Asset Market Clarity Act (CLARITY Act)

Republican Representative French Hill introduced the CLARITY Act only at the end of June. The bill aims to provide a framework for the digital assets industry, including defining the roles of the Securities and Exchange Commission and the Commodity Futures Trading Commission (CFTC).

The crypto industry has long thought that the Howey test, as outlined in the Securities Act of 1933 and the Securities Exchange Act of 1934, is out of date and that the SEC should not apply it nor exercise jurisdiction over digital assets.

The CLARITY Act would “provide an exemption from the Securities Act of 1933’s registration requirement for offers of investment contracts involving digital commodities on mature blockchains that meet certain conditions.”

It also defines “mature” blockchains as networks that have a digital commodity “substantially derived from the use and functioning of the blockchain.” It can’t have user restrictions and must limit certain holders to less than 20% of ownership.