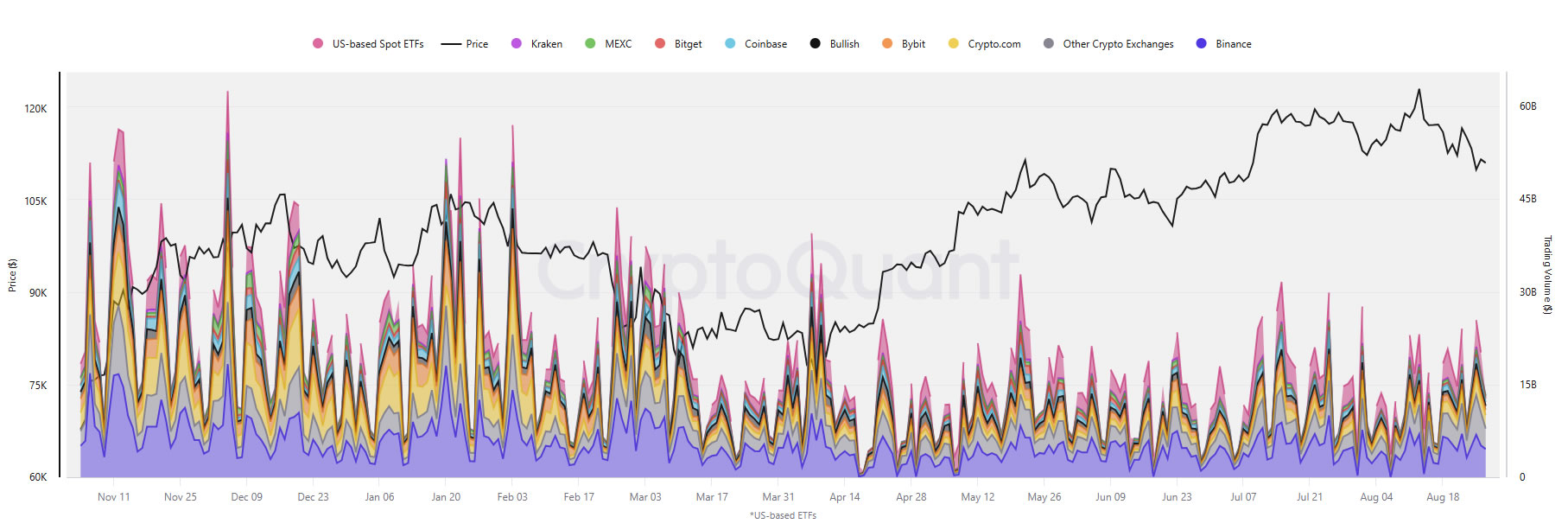

United States-based spot Bitcoin exchange-traded funds are now responsible for a significant share of daily spot trading as institutional investors have continued to warm to crypto.

“Bitcoin spot trading volumes through US-based ETFs have become a significant source of investor exposure to Bitcoin,” said Julio Moreno, head of research at blockchain analytics firm CryptoQuant, on Thursday.

US-based spot Bitcoin ETFs now regularly generate $5 billion to $10 billion in daily volume on active days, sometimes surpassing most crypto exchanges, “reflecting growing institutional demand,” he added.

Binance still leads in spot trading volume

However, the world’s largest crypto exchange, Binance, consistently leads in spot trading volume, he said.

Bitcoin volumes have surged to $18 billion, and Ether

ETH$4,349volumes have been as high as $11 billion on peak days.

Total daily trading volume for the 11 US spot Bitcoin funds is currently $2.77 billion, according to CoinGlass. This is around 67% of the daily spot Bitcoin volume on Binance, which is about $4.1 billion, according to CoinGecko.

Binance’s total daily volume for all of its pairs is around $22 billion.

“US spot Bitcoin ETFs have emerged as a dominant force in crypto markets and demonstrate their pivotal role in price discovery and institutional adoption,” director at LVRG Research, Nick Ruck, told Cointelegraph.

Moreno pointed out that ETH spot trading is mostly concentrated on Binance, followed by Crypto.com, and ETFs rank sixth at just 4%.

This underscores “limited ETF participation in ETH spot trading,” indicating “slower institutional adoption of Ethereum compared to Bitcoin.”

However, recent daily ETF figures tell a different story.

Bitcoin ETF flows slow as Ether takes over

Inflows into the eleven spot Bitcoin ETFs have slowed this week, totaling $571.6 million over the past four trading days, according to CoinGlass.